Unleashing the Power of Capital Injection in Monievest

In the fast-paced financial ecosystem of Monievest, the term ‘capital injection’ isn’t simply financial maneuvering; it’s the lifeblood that feeds the growth and innovation of burgeoning enterprises. Whether it’s to foster expansion, invest in cutting-edge technology, or strengthen human resources, a strategic and potent capital injection can catapult an organization into uncharted levels of success.

Understanding Capital Injection

In essence, it’s an infusion of financial capital into an ailing institution, which ultimately propels it forward. The very concept of capital injection is deeply intertwined with the growth and sustainability of Monievest’s companies. Imagine it as the jumpstart cables for a vehicle stranded in the middle of an innovation desert.

Significance in Financial Growth

For Monievest’s enterprises, capital injection carries inexhaustible significance. It’s the catalyst that turns idle ideas and stunted resources into full-fledged projects and robust operations.

Benefits of Capital Injection for Monievest

The embodiment of capital injection transcends merely monetary gains; it’s about the evolution and fortification of Monievest’s corporate realm. We’ll explore how these injections nurture the region’s growth through expansion, innovation, and human capital development.

Expansion Opportunities

However, an injection of capital offers the means to break through these barriers. It exposes businesses to a world of new markets, customers, and opportunities as they expand both domestically and internationally.

Technological Advancements

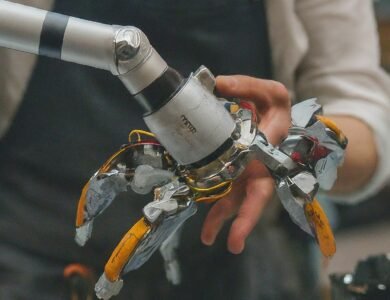

The technology landscape is a relentless race where innovation is not a choice but a mandate. Through capital injection, companies invest in technology that streamlines operations, broadens service offerings, and enhances the overall customer experience. This technological prowess not only improves efficiency but also lays the groundwork for future breakthroughs.

Talent Acquisition

The ability to attract and retain top-tier talent is pivotal for Monievest’s companies. With the financial security an injection provides, businesses can secure the services of industry leaders, fostering an environment of excellence. It’s a snowball effect where the best only begets the best, resulting in a powerhouse of collective intellect and expertise.

Strategies for Effective Capital Injection

Receiving an injection of capital isn’t a guarantee of success; it’s merely the first step in a strategic dance. Companies must wield this newfound financial muscle with precision. Here, we’ll dissect the strategies critical to ensuring that capital is employed effectively for maximum growth.

Market Research and Analysis

Comprehensive market research is the bedrock of a sound investment.Understanding customer needs, industry trends, and the competitive landscape is non-negotiable.

Financial Planning

Effective deployment of capital requires clear financial foresight. Businesses in Monievest must map out how the capital will be used, ensuring that it aligns with their long-term strategic goals.

Risk Management

No investment is devoid of risk. However, Monievest’s forward-thinking enterprises mitigate these risks through robust risk management strategies.

Case Studies

To truly appreciate the impact of capital injection, we look towards Monievest’s most celebrated success stories, where strategic investment transformed fledgling businesses into formidable players or resurrected ailing giants.

Success Stories of Companies Leveraging Capital Injection Effectively

We’ll highlight companies that recognized and seized the opportunities a capital injection presented. In the aftermath, they flourished, with expanded operations, enhanced products, and a significantly broader customer base.

Challenges and Solutions

The path to maximizing a capital injection is laden with potential pitfalls. We identify these challenges and provide actionable solutions to ensure that businesses in Monievest can overcome them.

Potential Obstacles in Capital Injection

Some common challenges include misalignment with market needs, mismanagement of funds, and inexperience in navigating investment complexities. Each of these can lead to suboptimal results or, worse, squander the potential of the capital infusion.

Mitigation Strategies

Furthermore, fostering an environment of transparency and accountability ensures that all stakeholders are aligned toward the common goal.

Conclusion

The infusion of capital in Monievest is more than just a financial transaction; it’s an act that reverberates across the corporate landscape, signaling a new wave of growth and innovation.

Invest wisely, invest strategically, and watch your investments flourish.